What to Know about Stocks and Bonds

Everyone talks about stocks and bonds. But what are they, how do they differ from each other, and is one better than the other? While it can seem like comparing…

Understanding Credit Cards During Economic Uncertainty

The last few years have been rife with economic uncertainty across the globe, and there is still concern that a recession is on the horizon. Paired with rising inflation across…

The Best Credit Cards for Beginners

All adults should have at least one credit card, either for emergencies or purchases that require a credit card, like renting a car. Beyond that, these cards are vital for…

Understanding a Retirement Budget

Understanding retirement budgets can feel like an enigmatic concept. After all, the goal is to ensure you have enough money to live comfortably until you die. No one knows when…

Planning a Budget with a Stable Income

Whether you have a stable salary or fixed income, understanding budgets is the key to making the best use of them. After all, a stable income means you know with…

Impulse Control and Credit Cards

Credit cards are often required for certain types of transactions, such as booking a hotel room, renting a car, and conducting safe online transactions. So even for people who are…

Credit Card Traps to Avoid

A credit card can be a useful financial tool to have in your back pocket, but it can also be a slippery slope to expensive debt. Avoid credit card traps…

Planning a Budget with Inconsistent Income

A budget is so much easier to create when you know how much money you’ll get in each paycheck. But when you work on commission or as a contractor for…

When to Start Saving for Retirement

Everyone says to begin saving for retirement as soon as possible, but is that always true? Know the Right Time for You The “best time” to save for retirement isn’t…

Credit Cards – A Necessary Evil

It’s rare to hear anyone proclaim their love for credit cards. More often, you’ll hear complaints about interest rates and debt. But credit cards don’t have to be a bad…

How to Save for Emergencies

A common piece of financial advice is to save big and save often… but for what? Before you start saving for fun goals, like a vacation or new car, it’s…

Do Credit Cards Make People Spend More?

Popular financial guru Dave Ramsey is no fan of credit cards. One of the reasons he cautions against using plastic for everyday purchases and emergencies alike is the argument that…

Will You Be Able to Sustain Your Current Lifestyle with Your Retirement Savings?

The average American knows little about saving for retirement and how much they’ll need to have socked away in a 401(k) or IRA before retiring. Although each person’s needs are…

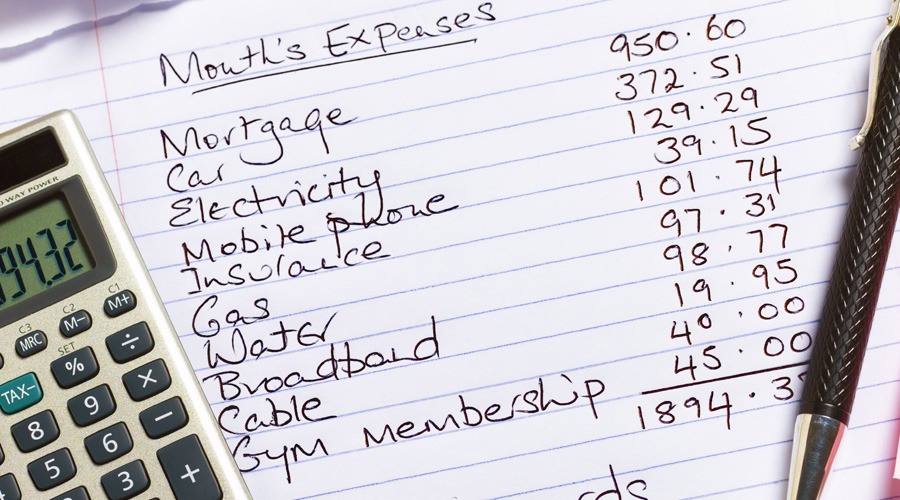

How to Create a Budget

If you’re struggling with debt or watching your finances turn upside down, creating a budget is one of the most effective ways to start managing your money instead of allowing…

Paying Off Debt the Easy Way

Are you struggling to pay off debt? Are you watching your balances increase with no real plan for taking control of your finances? If that sounds all too familiar, there’s…

Use These Four Tips to Buy Your First Home

When you are preparing to buy a new home for the first time, it can seem like a daunting process. But you can prepare ahead of time by using the…

Building Credit the Smart Way

Your credit score provides a snapshot of your financial history. Creditors use the information on your credit report to verify if you’re worthy of a loan, rental apartment or other…

Your Guide to Comparing Credit Score Ranges

Your financial history and credit score are a critical part of your financial life. Knowing where you stand will help you make smarter decisions when it comes to your finances.…

4 Everyday Tips for Serious Savings

It takes daily practice to successfully save money. Simply skipping any spending for one day won’t leave you with much extra in the bank–especially if you proceed to spend even…

5 Ways to Increase your Home Value

Every home owner desires to increase the overall value of his or her property, no matter how long they plan on living there. In addition to property values rising organically…